Karachi (HRNW) The Sindh government increased the sales tax from 13 to 15 percent with effect from July 1, media reported

The provincial government hiked the Sindh Sales Tax to 15 percent in a recently passed budget for the fiscal year 2024-25 which will apply to various businesses, including restaurants, hotels, and wedding halls.

According to the revised tax, restaurants, cafes, bakeries, and hotels will have to pay 15 percent sales tax.

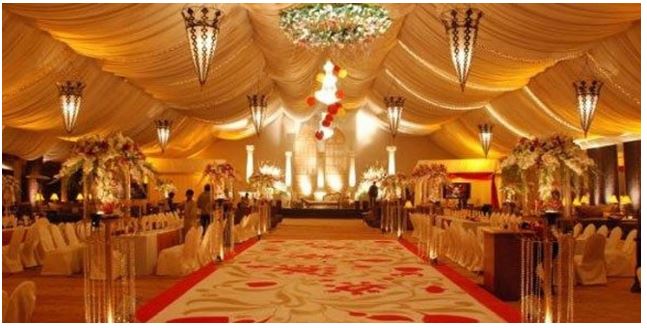

The guest houses, farmhouses, clubs, and wedding halls will also be charged 15 percent sales tax. The credit card payments will be subject to an 8 percent sales tax while the cash payments will be subject to a 15 percent sales tax.

“To promote digitalisation in the economy, it was proposed to reduce SST rate to 8percent for the restaurant services involving customers’ payments through digital means like debit/credit card, mobile wallet, QR Scanning, etc.

For promoting the Telecom services which pay high rate of 19.5percent SST but utilize input items paying Federal Sales Tax of up to 18percent (which was previously 17percent), it is proposed to allow them the input tax credit of up to 18percent instead of 17percent as at present,” Chief Minister Syed Murad Ali Shah said while presenting the budget